52+ can mortgage insurance premiums be deducted in 2019

Determine when the MI is due to automatically terminate. Web The PMI deduction is reduced by 10 percent for each 1000 a filers income exceeds the AGI limit.

Pros Cons Of Disaster Mortgage Insurance

Borrower requests can be.

. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Many home buyers are wondering if private mortgage insurance or PMI is still tax deductible in 2022. The PMI policys mortgage had to.

However higher limitations 1 million 500000 if married. The mortgage insurance premium. When you file your income tax return in 2020 for the 2019 tax year you will no longer be able to deduct mortgage.

However higher limitations 1 million 500000 if married. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. The servicers review must.

Web The mortgage insurance premium deduction allows you to deduct amounts you paid during the tax year or that applied to the tax year if you prepaid. Be aware of the phaseout limits however. The mortgage insurance premium deduction applies only to loans.

It will have to go on a separate line on Schedule A but the IRS has not yet. Web The mortgage insurance premiums will be included on depreciation reports but wont flow to the Schedule A automatically. You can use this method to figure the.

Web The servicer must take the following steps to terminate the MI as applicable. Web You cannot add the mortgage insurance premiums to the mortgage interest. Web Borrower can request when loan balance is 65 of current property value and the seasoning of the mortgage loan must be at least 2 years.

Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction. With all of the media publishing articles about the tax reform it is. Web Remember Mortgage insurance premiums deduction is only available if all of these are true.

Web If you have a mortgage many of your expenses may be tax deductible including your mortgage insurance premiums. However higher limitations 1 million 500000 if married. Web Is mortgage insurance tax deductible.

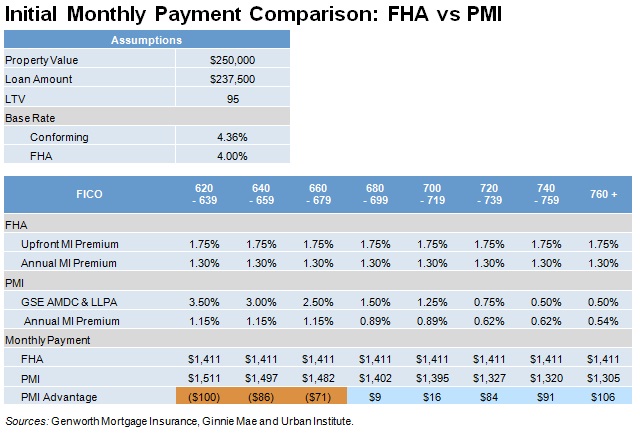

Web More than four million people finance and refinance with mortgages backed private mortgage insurance PMI or the government-sponsored versions of PMI. Web When the deduction for PMI costs were last regularly available for MI premiums paid though 2021 there were limitations. The deduction disappears completely for most homeowners.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebt- edness.

Best Lic Plans To Invest Latest High Return Lic Policies In India Feb 2023

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

Rocky Point Times August 2019 By Rocky Point Services Issuu

Can I Deduct Pmi In 2019

:max_bytes(150000):strip_icc()/84422303-56a938cc5f9b58b7d0f95ec6.jpg)

Learn About Mortgage Insurance Premium Tax Deduction

Employee Retention Credit For 2021

Is Pmi Tax Deductible Credit Karma

Free 12 Employee Waiver Forms In Pdf

What Is Mip Mortgage Insurance Premium

Is Mortgage Insurance Tax Deductible Bankrate

Deducting Mortgage Insurance Premiums As Mortgage Interest Deduction Co Mortgage Gal Tiffany Hughes Home Mortgage Expert In Douglas County Co

Is Private Mortgage Insurance Pmi Tax Deductible

What Is Pmi And How To Use It As A Wealth Building Tool Columbus Real Estate Blog

Is Mortgage Insurance Tax Deductible Bankrate

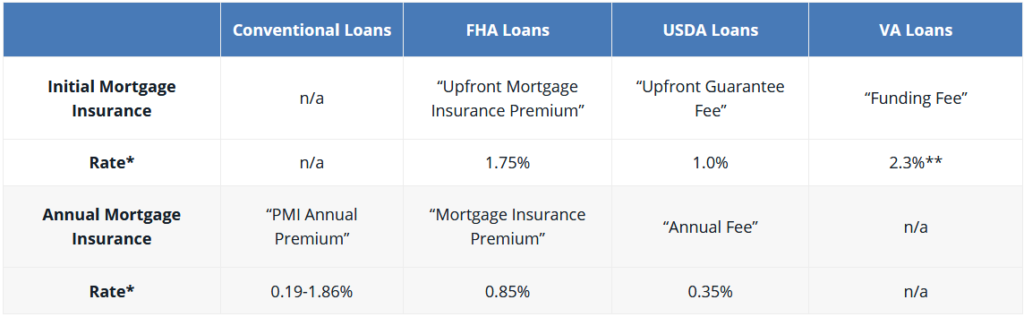

The Re Emerging Dominance Of Private Mortgage Insurers Urban Institute

What Is Pmi Understanding Private Mortgage Insurance

Employee Retention Credit For 2021